Unlocking Prosperity: Unveiling Key Characteristics in the Peak Phase of the Business Cycle

During the peak phase of the business cycle, a characteristic of prosperity is high levels of economic activity and growth. This phase is marked by increased business investment, consumer spending, and job creation, leading to overall economic growth and stability.

Prosperity in the peak phase of the business cycle is characterized by a vibrant economy with robust economic activity and growth. It is a period marked by high levels of business investment, consumer spending, and job creation, which leads to overall economic expansion.

Businesses experience increased sales and profits, leading to improved financial conditions. With a flourishing economy, individuals have higher disposable income, leading to increased consumer spending. This phase is also associated with low unemployment rates and a positive outlook for future economic growth. During prosperity, businesses and individuals are optimistic about the current and future state of the economy, fueling further economic expansion and prosperity.

Contents

- 1 The Business Cycle’s Peak Phase

- 2 Characteristics Of Prosperity

- 3 Challenges And Risks

- 4 Impact On Financial Markets

- 5 Policy Responses

- 6 Frequently Asked Questions Of Which Of The Following Is A Characteristic Of Prosperity In The Peak Phase Of The Business Cycle?

- 6.1 Q: What Are The Characteristics Of Prosperity In The Peak Phase Of The Business Cycle?

- 6.2 Q: How Does The Peak Phase Of The Business Cycle Affect Businesses?

- 6.3 Q: What Role Does Innovation Play In The Peak Phase Of The Business Cycle?

- 6.4 Q: How Does The Peak Phase Of The Business Cycle Impact Employment Rates?

- 6.5 Q: What Can Consumers Expect During The Peak Phase Of The Business Cycle?

- 6.6 Q: Are There Any Risks Associated With The Peak Phase Of The Business Cycle?

- 7 Conclusion

The Business Cycle’s Peak Phase

During the peak phase of the business cycle, prosperity is characterized by high levels of employment, consumer spending, and business profits. This phase also sees heightened investment activities and a general sense of optimism in the economy. As a result, demand for goods and services is strong, leading to overall economic growth.

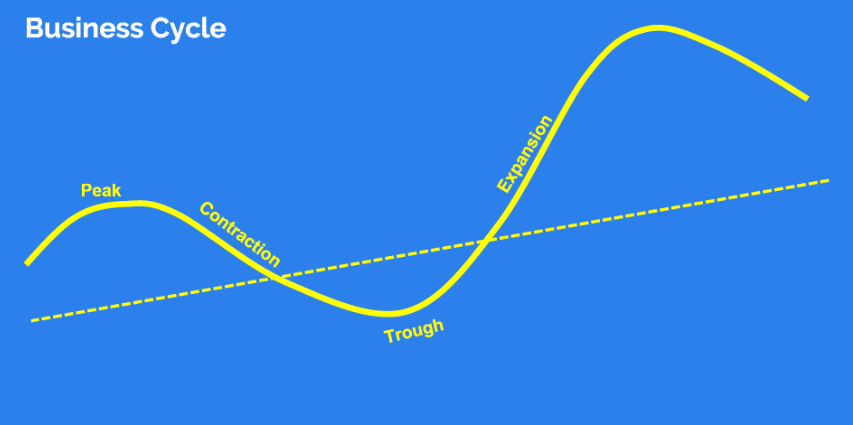

The peak phase of the business cycle is the period when the economy reaches its highest point before transitioning into a downturn. It is characterized by robust economic activity and is often associated with prosperity and high levels of business and consumer confidence. Understanding the peak phase is crucial for businesses and investors as it helps them make informed decisions regarding expansion, investment, and future prospects.

Defining The Peak Phase

The peak phase of the business cycle can be defined as the stage where economic activity reaches its maximum level before starting to decline. It marks the apex of economic growth and prosperity. During this phase, the economy operates at its full potential, with businesses experiencing high production levels and consumers enjoying increased purchasing power.

Economic Indicators Of The Peak

Several economic indicators can be used to identify the peak phase of the business cycle. These indicators provide valuable insights into the current state of the economy and help analysts and policymakers gauge its overall health. Here are some commonly observed economic indicators during the peak phase:

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country in a given period. During the peak phase, GDP tends to show strong growth, indicating a buoyant economy and increased economic output.

- Low Unemployment Rate: The peak phase is often characterized by low levels of unemployment, with more individuals finding gainful employment. This is a result of high business activity and increased job opportunities, leading to a lower number of unemployed individuals in the economy.

- High Consumer Confidence: Consumer confidence reflects the optimism and willingness of individuals to spend and invest in the economy. During the peak phase, consumer confidence tends to be high as people have stable jobs, increased income, and positive expectations about the future.

- Rising Stock Market: The stock market performance is considered a reliable indicator of the overall health of the economy. In the peak phase, the stock market tends to exhibit strong performance, with stock prices rising as investors have positive expectations and confidence in the market.

- Increased Business Investment: Business investment tends to be robust during the peak phase as businesses experience high profits and growth prospects. Increased investment in machinery, infrastructure, and expansion projects indicates a thriving business environment and a strong overall economy.

- Stable Interest Rates: During the peak phase, interest rates tend to remain stable or slightly higher. This indicates that the central bank aims to prevent overheating of the economy while maintaining stable inflation levels.

Characteristics Of Prosperity

Prosperity is a phase in the business cycle where the economy is booming, businesses are thriving, and the overall financial outlook is positive. This period is marked by several key characteristics that indicate economic prosperity. Let’s explore three significant characteristics of prosperity in the peak phase of the business cycle: Increased Consumer Spending, Rising Corporate Profits, and Sustained Economic Growth.

1. Increased Consumer Spending

During the peak phase of the business cycle’s prosperity, one of the key characteristics is Increased Consumer Spending. As the economy improves, people have more disposable income to spend on goods and services. This increased spending not only benefits individuals but also contributes to overall economic growth and stability.

Consumer spending has a significant impact on various sectors of the economy, including retail, entertainment, and hospitality. When consumers are confident about their financial future, they tend to spend more, which results in a surge in demand for products and services. This increased demand, in turn, leads to higher production levels, job creation, and further economic growth.

2. Rising Corporate Profits

Another key characteristic of prosperity in the peak phase of the business cycle is Rising Corporate Profits. During this phase, businesses experience an upswing in profitability and enjoy favorable market conditions. Companies witness higher sales, increased demand for their products, and improved market share, leading to higher revenues and profits.

Rising corporate profits have several positive effects on the economy. Firstly, they incentivize businesses to invest in expansion, research and development, and employee training. This increased investment leads to job creation, innovation, and improved productivity. Secondly, higher corporate profits also result in increased tax revenues for the government, which can be further used to invest in public infrastructure and welfare programs.

3. Sustained Economic Growth

One more significant characteristic of prosperity in the peak phase of the business cycle is Sustained Economic Growth. During this phase, the overall economy experiences consistent growth in terms of gross domestic product (GDP), employment, and productivity. It signifies progress and stability in various sectors, contributing to the overall well-being of the economy.

Sustained economic growth brings numerous advantages for individuals and businesses alike. It creates a favorable environment for entrepreneurship, encourages investment, and fosters job creation. Additionally, sustained economic growth allows for the development of a robust consumer market, attracting foreign investments, and strengthening international trade relations.

Challenges And Risks

Inflation Pressures

During the peak phase of the business cycle, one of the characteristic challenges is the presence of inflation pressures. Inflation can skyrocket, causing the cost of goods and services to soar, thus impacting consumer purchasing power. Businesses may face rising input costs which can eat into their profit margins.

Potential Overinvestment

Another risk during the peak phase of the business cycle is the potential for overinvestment. Businesses may experience a surge in demand and may be tempted to overinvest in their capacity and infrastructure. This could lead to overcapacity or excessive debt if the demand does not sustain over the long term.

Impact On Financial Markets

Prosperity in the peak phase of the business cycle brings about various impacts on financial markets, including increased investment activity, rising stock prices, and higher demand for goods and services. This phase is characterized by robust economic growth and consumer confidence, leading to favorable conditions for businesses and investors.

During the peak phase of the business cycle, several characteristics of prosperity emerge. One of the crucial areas that witnesses significant changes is the financial market. The impact reaches both the stock market and the bond market, bringing about shifts in behavior and dynamics respectively.

Stock Market Behavior

In this phase, the stock market experiences a unique pattern of behavior. Investors tend to display a higher sense of optimism and take on a more risk appetite. As a result, stock prices typically soar, reflecting the overall buoyancy in the market. Companies may witness an upward trajectory in their stock values, which can lead to increased wealth for shareholders. It is essential to note that market sentiment plays a vital role and can also contribute to the amplified volatility in stock prices.

Bond Market Dynamics

The bond market, on the other hand, witnesses particular dynamics during the peak phase of the business cycle. As prosperity reigns, investors tend to move away from bonds and seek higher-yielding alternatives, such as stocks. This shift in preference for riskier assets often leads to a decrease in demand for bonds, causing their prices to decline.

Consequently, bond yields increase, offering greater returns to those willing to invest in fixed-income securities. This change in dynamics signifies a transition from a bond-oriented market to one that favors equity investments.

Policy Responses

During the peak phase of the business cycle, a characteristic of prosperity is the implementation of policy responses aiming to sustain economic growth and stability. These policies often involve measures such as fiscal stimulus, monetary easing, and investment incentives to boost businesses and consumer confidence.

In the peak phase of the business cycle, characterized by prosperity, policymakers have a crucial role to play in maintaining the momentum and managing potential risks. Policy responses are implemented at both the central bank and government levels. These responses aim to sustain economic growth, control inflation, and ensure stability in the financial system. Two key elements of policy responses in the peak phase are central bank actions and government fiscal policies.

Central Bank Actions

Central banks take various measures to manage the business cycle during its peak phase. The primary focus is on maintaining price stability and supporting economic growth. Through monetary policy, central banks aim to influence interest rates and regulate the supply of money in the economy. Some actions commonly undertaken by central banks include:

- Adjusting interest rates to manage inflation and control borrowing costs.

- Implementing open market operations to influence the money supply and liquidity in financial markets.

- Conducting reserve requirement changes, which can impact bank lending and overall credit conditions.

- Engaging in forward guidance to provide clarity and predictability to financial markets regarding future monetary policy actions.

These measures allow central banks to respond flexibly to economic conditions and navigate any potential downturns in the business cycle.

Government Fiscal Policies

Governments also play a significant role in managing the business cycle during the peak phase. Fiscal policies are implemented to support economic growth, stabilize public finances, and ensure a favorable business environment. Some common fiscal policy responses include:

- Implementing expansionary fiscal policies, such as increasing government spending or reducing taxes, to stimulate economic activity.

- Conducting countercyclical policies, aiming to stabilize economic fluctuations by adjusting government spending and taxation in response to the business cycle.

- Investing in infrastructure development, which can create jobs, enhance productivity, and stimulate overall economic growth.

- Ensuring prudent debt management to maintain the credibility of public finances and prevent potential financial instability.

These government measures work in conjunction with central bank actions to maintain a stable and prosperous economic environment during the peak phase of the business cycle. By coordinating their policies, policymakers aim to mitigate potential risks and sustain the positive momentum of economic activity.

Frequently Asked Questions Of Which Of The Following Is A Characteristic Of Prosperity In The Peak Phase Of The Business Cycle?

Q: What Are The Characteristics Of Prosperity In The Peak Phase Of The Business Cycle?

A: During the peak phase of the business cycle, economic indicators show high growth, low unemployment rates, and increased consumer spending.

Q: How Does The Peak Phase Of The Business Cycle Affect Businesses?

A: Businesses experience increased demand for their products or services, leading to higher profits and expansion opportunities.

Q: What Role Does Innovation Play In The Peak Phase Of The Business Cycle?

A: Innovation becomes crucial as businesses strive to stay competitive, adapt to changing market trends, and meet consumer demands.

Q: How Does The Peak Phase Of The Business Cycle Impact Employment Rates?

A: Employment rates tend to be low during the peak phase, as businesses hire more workers to meet the rising demand.

Q: What Can Consumers Expect During The Peak Phase Of The Business Cycle?

A: Consumers can expect a wide range of products and services, competitive prices, and a strong job market with ample employment opportunities.

Q: Are There Any Risks Associated With The Peak Phase Of The Business Cycle?

A: Yes, risks such as inflation, overproduction, and an unsustainable surge in consumer spending can lead to economic downturns if not managed effectively.

Conclusion

Understanding the characteristics of prosperity in the peak phase of the business cycle is vital for businesses. By recognizing these traits such as high employment, rising wages, and increased consumer spending, organizations can adapt their strategies to leverage opportunities and mitigate risks during this stage.

Embracing these characteristics can lead to sustainable growth and success.